|

|

Okay, the user just sent "BTC". That's pretty minimal. Let me unpack this.

First, I need to consider possible interpretations. Could be Bitcoin, could be something else entirely. But given the context of crypto, Bitcoin is the most obvious candidate. The user might be testing if I recognize the abbreviation, or maybe they're in a hurry and just want a quick overview.

Hmm, the brevity makes me think they might be new to crypto. If they were experienced, they'd probably ask something more specific. But I shouldn't assume too much. Maybe they're just being efficient after a long day.

I should cover the basics but keep it scannable. Price is always the first thing people ask about, so that's priority one. Then key facts to establish credibility - market cap, supply, etc. The "why it matters" section is crucial because new users often don't grasp why Bitcoin is special beyond just price.

Oh! Important to include the risks too. Last thing I want is someone seeing this and panic-buying at a peak. The volatility disclaimer isn't just CYA - it's responsible advice.

The tone should be neutral but slightly enthusiastic - crypto is exciting but dangerous. No hype, no FUD. Just facts with context. And ending with an open question feels right - gives them control over where to go next. If they want to dive deeper, they'll ask. If not, they got what they needed.

...Wait, should I have asked what they specifically wanted to know? No, for such a short query, better to provide value immediately. They can always clarify if needed.

BTC most commonly refers to Bitcoin, the world's first and largest cryptocurrency by market capitalization. Here's a concise overview:

Key Facts about Bitcoin (BTC):

Purpose:

A decentralized digital currency operating on a peer-to-peer network (no central bank/government control).

Designed as a store of value ("digital gold") and medium of exchange.

Technology:

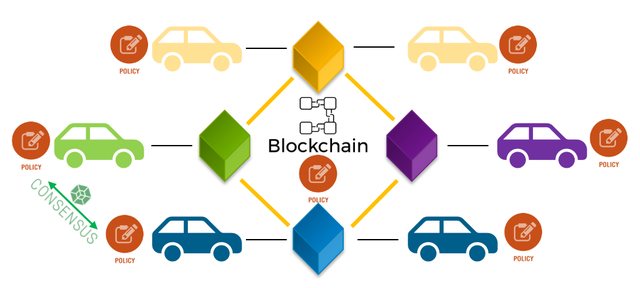

Built on blockchain technology 鈥?a distributed, immutable ledger.

Uses Proof-of-Work (PoW) mining for security (energy-intensive process).

Supply:

Capped supply: Maximum of 21 million coins (expected to be fully mined by ~2140).

Current Supply: ~19.7 million BTC (as of mid-2024).

Halving: Approximately every 4 years, rewards for miners are cut in half (next halving expected in April 2024).

Market Status:

Dominance: ~50% of total crypto market cap.

Volatility: Highly price-sensitive (e.g., surged to ~69,000 in Nov 2021, dropped to ~16,000 in Nov 2022).

All-Time High (ATH): $73,750 (March 2024).

Use Cases:

Payments: Increasing merchant adoption (e.g., Tesla, Microsoft).

Investment: Held as a hedge against inflation/currency devaluation.

DeFi: Used in lending, staking, and yield farming.

Challenges:

Scalability: Slow transaction speeds (~7 TPS) and high fees during peak times.

Regulation: Varying global policies (e.g., banned in China, legal tender in El Salvador).

Environmental Impact: PoW mining consumes significant energy.

Why It Matters:

Pioneer: Launched in 2009 by "Satoshi Nakamoto," it kickstarted the crypto revolution.

Institutional Adoption: ETFs approved in the U.S. (2024) attract mainstream investors.

Cultural Impact: Symbol of financial freedom and technological disruption.

Risks:

Extreme volatility.

Regulatory crackdowns.

Security risks (hacks, scams).

Environmental concerns.

Want to dive deeper? Ask about:

How to buy BTC?

Bitcoin vs. Ethereum?

Future price predictions?

Mining explained?

Or something else! 馃槉

|

|