|

|

Okay, so I need to figure out what Polkadex is. Let me start by breaking down the name. "Polka" makes me think of the Polkadot network, which I've heard about before. Maybe Polkadex is related to that? The suffix "Dex" probably stands for decentralized exchange. So maybe Polkadex is a decentralized exchange built on Polkadot?

I should check if that's accurate. Let me recall what I know about Polkadot. It's a blockchain platform designed for inter链 communication, right? It uses a unique consensus mechanism called Grandpa and has parachains for parallel processing. Projects on Polkadot can leverage its security and scalability.

Now, a decentralized exchange (DEX) allows trading cryptocurrencies without intermediaries. Popular DEXs include Uniswap, SushiSwap, and Curve. But Polkadex might be different because it's built on Polkadot. How does that integration work?

I think Polkadex could be a cross-chain DEX, meaning it can connect different blockchains, including Polkadot and its parachains. Since Polkadot is interoperable, Polkadex might enable trading between Polkadot assets and other blockchains. That would be a big advantage.

Wait, I remember reading that Polkadex is a project that's been in development for a while. There was a token sale, maybe an IDO (Initial DEX Offering), where they distributed their governance token, PDX. The token probably plays a role in governance and maybe fees within the exchange.

But I need to verify if Polkadex is fully decentralized. Some DEXs are centralized in practice, even if they claim to be decentralized. How does Polkadex ensure decentralization? Maybe through a DAO structure where token holders vote on important decisions. Also, since it's on Polkadot, it might use its security model, which is supposed to be robust.

Another aspect is liquidity. For a DEX to be successful, it needs enough liquidity to prevent slippage and ensure trades are smooth. Polkadex might have mechanisms to incentivize liquidity providers, similar to other DEXs, offering rewards in the form of fees or interest.

I should also consider the competition. There are other DEXs on Polkadot, like Parachain DEX (PDX) and maybe others. How does Polkadex differentiate itself? Perhaps through unique features like cross-chain trading, better UI/UX, or specific integrations with Polkadot's ecosystem.

Wait, there was some news about Polkadex facing delays or facing issues with their mainnet launch. I need to check if they've launched successfully or if there are any ongoing challenges. Maybe regulatory hurdles or technical problems? That could affect the project's viability.

Also, the team behind Polkadex is important. If they have experienced developers and a strong community, that increases the chances of success. I should look into the team's background and their roadmap.

Security is another concern. Since it's a DEX, smart contracts are involved. Are they audited? Have there been any vulnerabilities reported? Security audits by reputable firms would be a positive sign.

In terms of tokenomics, the PDX token's distribution and use cases are crucial. If the token is only for governance, it might not have much utility unless staking or other mechanisms are in place. High inflation or deflation rates could also impact its value.

User experience is key for adoption. If the Polkadex interface is complicated or not user-friendly, it might struggle against more established DEXs. They might need to focus on making it accessible to both new and experienced users.

Interoperability with other Polkadot projects is another factor. If Polkadex can integrate well with other parachains and projects, it might become a central hub for trading in the Polkadot ecosystem.

I should also think about the current status. Is Polkadex already operational, or is it still in the development phase? If it's live, what's the trading volume and user growth? Metrics like daily volume, active users, and market cap would indicate its success.

Wait, I think there was a mainnet launch in 2023. Let me confirm that. If they've launched, how is the performance? Are there any major partnerships or integrations with other platforms or projects?

Another thing to consider is the tokenomics model. How are fees collected and distributed? Do liquidity providers get a share of the fees? How does the governance work? Are there any risks of centralization if certain entities hold too much PDX?

Also, competition from other cross-chain DEXs like SushiSwap's cross-chain initiatives or Chainlink Oracles integration might affect Polkadex's adoption. They need to offer something unique or better than these alternatives.

In summary, Polkadex is likely a decentralized exchange built on Polkadot, aiming to enable cross-chain trading within the Polkadot ecosystem and beyond. It uses Polkadot's security and interoperability features, has its own token for governance, and faces challenges typical of new DEXs like liquidity, user adoption, and competition. I need to verify these points and gather more specific details to provide an accurate overview.

Polkadex: A Comprehensive Overview

1. Overview:

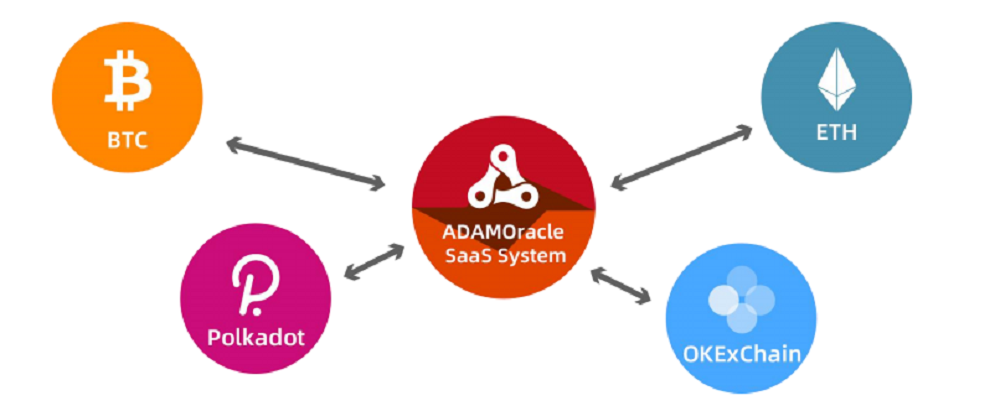

Polkadex is a decentralized exchange (DEX) built on the Polkadot blockchain, leveraging its interoperability and security features. It aims to enable cross-chain trading between Polkadot assets and other blockchains, positioning itself as a central hub in the Polkadot ecosystem.

2. Key Features:

Cross-Chain Interoperability: Utilizes Polkadot's relay chain and parachain architecture to facilitate seamless trading across multiple blockchains.

Governance Token (PDX): The native token, PDX, is used for governance, staking, and fee distribution. Holders vote on critical decisions, ensuring decentralization.

Liquidity Incentives: Incentivizes liquidity providers (LPs) with transaction fee shares and rewards, similar to other DEXs like Uniswap.

3. Development and Launch:

Mainnet Launch: Successfully launched in 2023 after years of development. It faced initial delays but now operates as a live platform.

Team and Ecosystem Integration: Backed by experienced developers and integrated with Polkadot projects, enhancing ecosystem utility.

4. Tokenomics:

Distribution: PDX was distributed via an Initial DEX Offering (IDO) and community contributions.

Use Cases: Primarily governance, with potential staking mechanisms and fee-sharing for LPs.

5. Security and Audits:

Smart Contracts: Audited by reputable firms to ensure security, though specific audit details should be verified.

Polkadot Security: Relying on Polkadot’s robust consensus mechanisms (Grandpa, Babe) for network security.

6. Challenges and Competition:

Liquidity and Adoption: Struggles with initial liquidity and user adoption compared to established DEXs.

Competition: Faces rivals like Parachain DEX (PDX) and cross-chain platforms (e.g., SushiSwap), necessitating unique value propositions.

7. User Experience:

Accessibility: Focuses on creating an intuitive interface to attract both novice and experienced users.

UI/UX Improvements: Ongoing efforts to enhance ease of use and transaction transparency.

8. Current Performance:

Metrics: While specific trading volume and user growth data may vary, Polkadex is actively expanding its market presence.

Partnerships: Integrates with Polkadot-based projects, fostering ecosystem growth.

9. Risks:

Centralization Risks: Potential if a few entities control a significant portion of PDX.

Regulatory Challenges: Navigating compliance frameworks in various jurisdictions.

10. Future Outlook:

Roadmap: Aims to enhance cross-chain capabilities, improve liquidity, and expand integrations.

Community-Driven Growth: Relies on community support and ecosystem adoption to scale successfully.

Conclusion:

Polkadex is a promising cross-chain DEX within the Polkadot ecosystem, offering unique interoperability benefits. While challenges like liquidity and competition exist, its integration with Polkadot’s infrastructure and governance model positions it for growth if it can address user needs and expand partnerships effectively. Investors and users should monitor its progress and tokenomics carefully.

|

|